While, for example, marketplaces and offline/ hybrid retailers have lived side by side for many years, these lines are becoming increasingly blurred. On the one hand, marketplaces want to be more than just that, and invest effort and money into “curated shopping” experiences, as recently seen in Amazon’s fashion push. On the other, retailers increasingly choose to operate a platform strategy in order to increase offer breadth. While this will result in more traffic it will also bring an exponential growth in SKUs to manage.

The latter trend poses significant challenges to any retailer from the “old world” that tries to manage the increased number of products with the same organizational set-up, tools, and capabilities. In particular for non-food categories, retailers need to bring category management to a whole different level in order to remain competitive.

Challenge: Dramatically increasing number of SKUs and resulting decision complexity

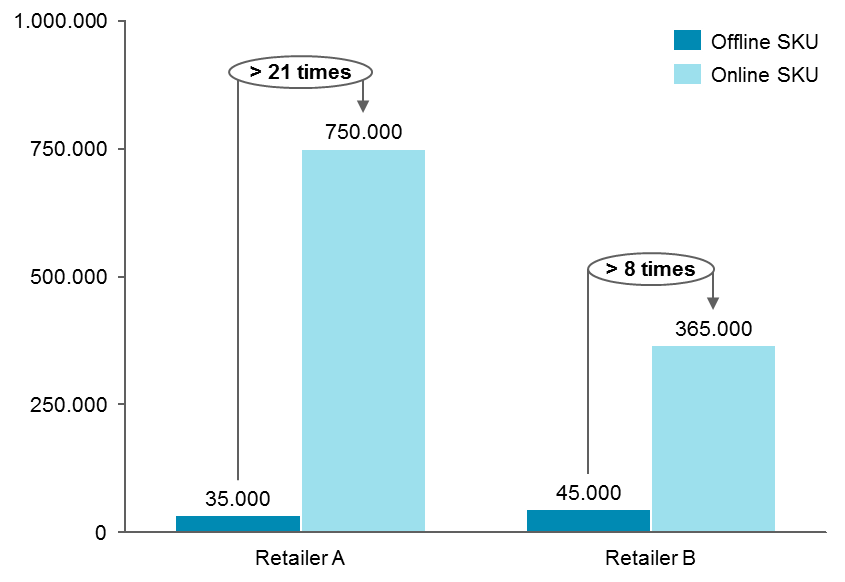

With the absence of physical shelf space restrictions in e-commerce, retailers have dramatically broadened their assortment catalogue. In some instances, this is a deliberate long-tail strategy in order to differentiate the offer. In other instances, a proliferation of SKUs is the unwanted result of a lack in top-down driven category management discipline. Exhibit 1 shows an example for two major European consumer electronics retailers:

While there is also the important consideration of the impact on a retailer’s perception from this kind of assortment strategy, we will focus more closely here on the impact this has on category management execution and decision quality.

At its core, we are seeing that an increasingly large number of SKUs, coupled with shorter product lifecycles and more decisions to be taken for each article, leads to a perfect storm for non-food retailers across sectors such as consumer electronics or textiles.

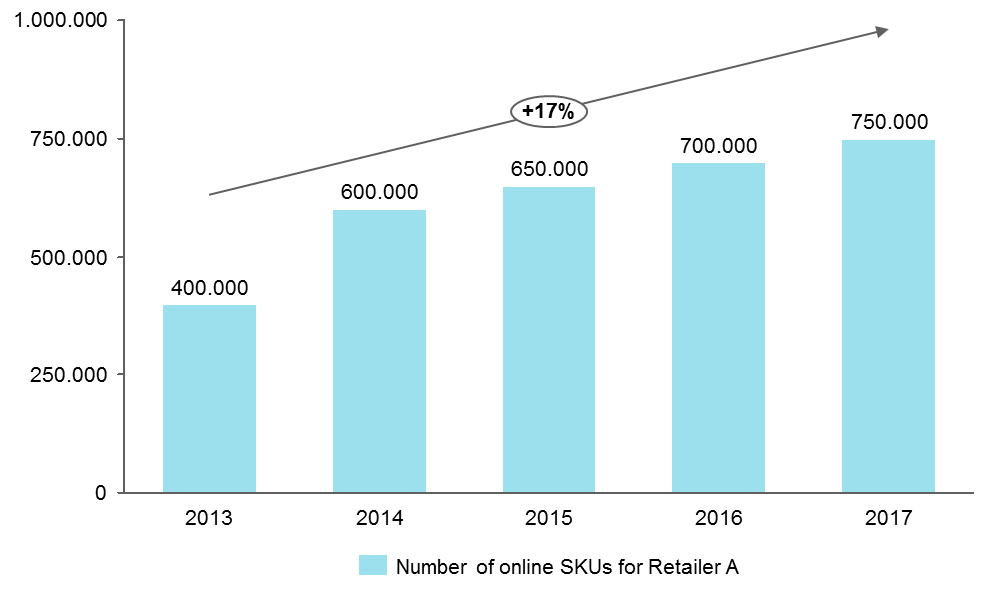

Watching this trend for an extended period of time, we track a strong and consistent catalogue growth in most retail sectors. In the example of retailer A, we have seen a CAGR of 17 percent in number of SKUs – almost doubling the assortment catalogue in just four years (see Exhibit 2). Extrapolating the developments, total SKU counts of 1,000,000 and more will no longer seem absurd for retailers operating in sectors like consumer electronics.

Additionally, operating multiple channels, e.g. adding an online-channel alongside a brick-and-mortar business, can not only lead to much broader catalogues but also add complexity in cases where prices or CRM measures are differentiated across channels, e.g. a presence in the online channel often leads to a sharp increase in the number of price changes. Incumbent retailers willing to succeed will need to adapt to these new retail realities: more SKUs to manage, across more channels, coupled with a higher number of decisions to be made.

Last but not least, we are observing an ongoing shortening of product lifecycles. Commercial innovations (e.g. new packaging, feature updates) are gaining importance among CPGs to generate a constant “news flow”. In turn, this implies additional complexity for the retailer to manage these changes, given that even smallish tweaks to products trigger a new product in retailers’ systems.

These trends combined represent a fundamental challenge to many non-food retailers that only few master to-date. Most try to maintain the same set-up and approach that worked for them in the past. They try to operate with the same category management organisation, the same resources and the same tools which has a significant impact on decision making quality. To mitigate this, a paradigm shift in decision making approach and efficiency is required.

Implications for retail category management

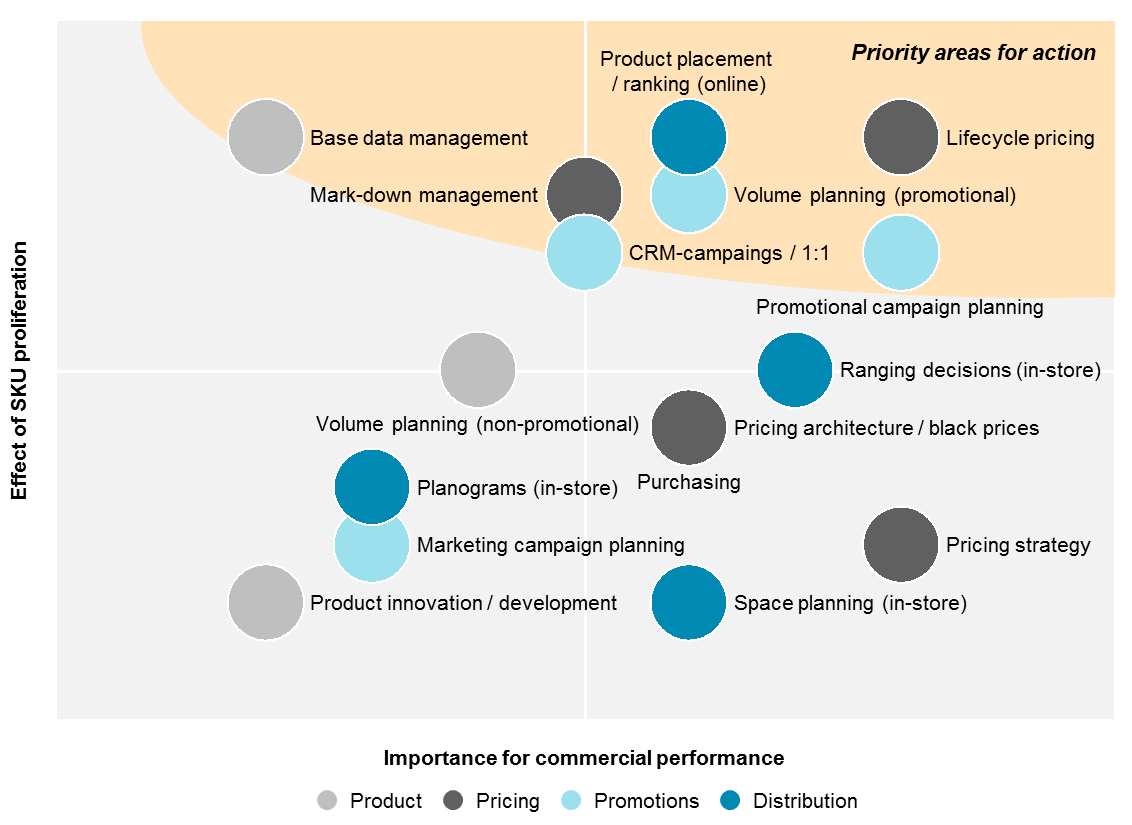

For retailers to master the challenges of increasing numbers of SKUs and decisions required, we propose taking a de-averaged view of the ingredients of contemporary category management. Exhibit 3 shows the priority areas for action, based on interviews with industry experts. The horizontal axis represents the importance of certain activities for the commercial performance of a retailer. The vertical axis adds an important dimension: to what extent does the effort for a certain activity scale up with an increasing number of SKUs.

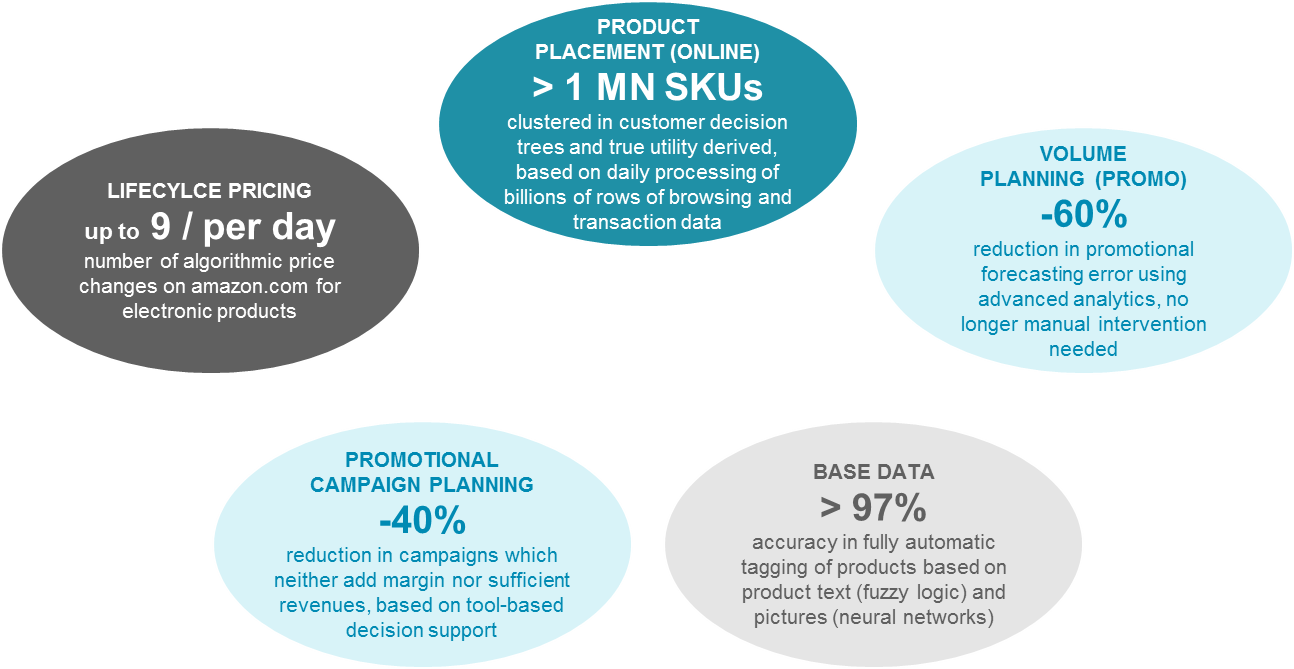

Recent examples from leading global retailers also highlight (see Exhibit 4) the role technology can play in some of these key areas to address. While global online retailers are typically leading the way in using technology, there is generally no barrier to applying the very same techniques in a traditional brick-and-mortar business.

More broadly, to mitigate these challenges for category management and turn a gloomy scenario into a winning opportunity, we see four key measures to make the category management organisation fit for the digital age:

- More with less: Invest in technology to relieve your category management from non-value adding tasks, e.g. base data management or volume forecasting, and let them focus on where their capabilities are really needed

- Put data at the core: Strong data analytics capabilities will become crucial for an effective category management. In most processes, e.g. pricing, management by exception will become the most effective approach - and will require a strong analytical backbone to truly exploit its potential

- “Think Apple”: Often, “data centricity” is leading to unused “data cemeteries”. Best practice retailers focus on providing intuitive, tailored decision support tools

- Rethink your capabilities: Given measures 1-3, the necessary capabilities for a category manager will change dramatically - now requiring deep commercial and product expertise to be balanced with strong analytical capabilities