What if one insurer could really transform the industry and grab the lion's share of the value for its investors?

People view life insurance as a mature industry, one that has stabilized around well-understood and accepted offers. We take a different view: there’s potential for huge growth and high profitability by pleasing the customer and daring to break out of old management traps.

Put another way, the low-growth category known as insurance could well be poised for high-growth category reinvention, by rethinking the core propositions around customer needs.

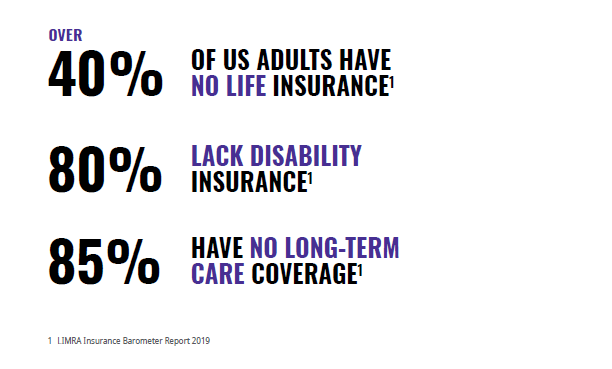

It's clear there's a massive opportunity to help US consumers improve their financial lives.

Against this backdrop, it doesn’t seem sensible that US Life insurers should be struggling to add significant shareholder value. The industry’s distinguishing characteristic is the ability to underwrite biological and financial risks, and its core purpose is often expressed as improving financial safety for consumers.

At Oliver Wyman, our Insurance team approaches the marketplace through the lens of clients, who are struggling with expensive distribution models, persistently high-cost operations, fragmented legacy systems and multiple layers of intermediation between insurers and the end customer.

This is the first article in our Reinventing Insurance series.