However, the payment experience – albeit central to the journey – has long been neglected, with retailers generally choosing to outsource the responsibility to banks, largely due to its complexity. While making payments may seem run-of-the-mill and seamless to many customers, complexity arises as shopping channels, technology, issues with types of payment, and consumer preferences evolve rapidly.

Retailers are beginning to develop strategies around integrating payments into their value proposition. While some still see payment as a process to be optimized from a technical and cost standpoint, implementing the right payments strategy is an opportunity for retailers to gain a real strategic advantage.

A seamless payment experience is the differentiator that Amazon, Uber, and WeChat all have in common

Have you ever wondered what business trait Amazon, Uber, and WeChat have in common? All of them have harnessed the untapped power of the payment experience in enhancing the customer journey, and have based their success on it.

Amazon is leading the way in using payment as a strategic control lever. The company offers countless forms of payment, checkout is fast and seamless, and payment is secure. The Amazon payment experience is a differentiator: For the same product at the same price, users will often choose Amazon for its 1-Click button ordering. In addition to using payment as a pillar of its value proposition, Amazon has further used payment as a loyalty tool to expand its business and to capture larger market share and profitability.

Amazon Prime Reload: This offers 2 percent cash-back to Amazon Prime customers when they load money from a bank account or debit card into their Amazon prepaid account. Amazon Prime Rewards Visa Signature Card: This is a relaunch of the Prime Credit Card, targeted at Amazon Prime customers to encourage loyalty. Card users are entitled to 5 percent cash-back for purchases made on Amazon and 1 percent to 2 percent cash-back on purchases at other retailers.

Uber has frictionless payment capabilities that are the most powerful assets of the centralized customer journey platform. A cashless experience for car transportation was the differentiator that formed the foundation for Uber’s success among drivers and users. More recently, Uber has expanded its payment and service offerings outside of its core application.

Uber digital payment: Uber accepts various digital payment methods including PayPal, Alipay, WageWorks commuter credit, and Apple Pay. It also uses its underlying payment platform (among other synergetic assets) to develop Uber Eats, a restaurant marketplace app, which successfully entered an already competitive market by offering a well-proven and seamless payment experience.

Driver Instant Pay: Uber has enhanced its payment experience for drivers as well. The Instant Pay solution allows drivers to get paid up to five times per day, helping to address their short-term liquidity concerns. For a small fee, this service allows cash to be taken out with an Uber debit card or personal card.

WeChat has transformed itself from a basic instant messaging and social media platform to a holistic ecosystem that connects people, services, and businesses. The company’s swift rise to success can be attributed, in no small measure, to the introduction of WeChat Pay, a digital wallet that allows users to make mobile payments and send money between contacts. WeChat Pay contains numerous payment capabilities and offerings, which have significantly affected how people use and interact with the application.

Peer-to-peer payment: Users who provide bank account information can transfer money into a friend’s WeChat Wallet balance. Recipients can then pay it into their personal accounts or use the funds for other purchases through WeChat. Commercial transactions: Consumers can now use the app to pay bills, order and pay for a cab, and purchase goods online. Companies use WeChat Pay in four ways: in-app payment, QR code payment for desktop websites, e-commerce for owned channels, and quick pay for in-store purchases.

Thanks to its unique payment experience and offerings, WeChat has grown from roughly 400 million users in 2014, when it introduced WeChat Pay, to around one billion registered users today, 800 million of whom use WeChat Pay.

Unfortunately, most retailers fail to offer a seamless payment experience to their shoppers

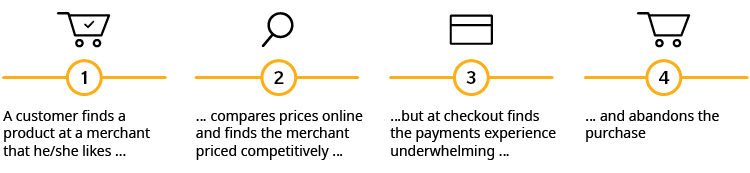

Retailers have generally been very attentive to providing a differentiated and enjoyable customer experience, but have neglected the payment dimension. For customers, the payment experience is poor, making the checkout process underwhelming at best. The “VWO eCommerce Cart Abandonment Report 2016” has shown online cart abandonment rates as high as 60 percent to 80 percent, and the magnitude of missed sales is massive (Exhibit 1). The same holds true for physical stores, where the use of EMV (Europay, Mastercard, Visa) chip cards and slow point-of-sale hardware terminals cause a poor purchasing experience, affecting customer satisfaction and, ultimately, store traffic.

Exhibit 1: Getting payments wrong has a high cost

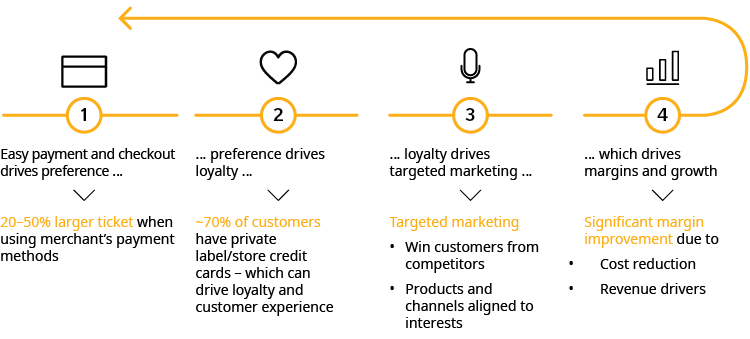

EXHIBIT 2: Getting payments right boosts sales and loyalty

Oliver Wyman analysis, Morgan Stanley Research

Payment is a crucial and largely untapped opportunity for retailers to increase revenues and improve profitability

Creating a payments strategy that enhances the consumer experience can simultaneously develop loyalty and grow revenues, as well as optimize margins (Exhibit 2). How?

LEVERAGE PAYMENTS AS A LOYALTY TOOL TO DEVELOP CLIENTS

Payments can serve as a hook for retailers to drive penetration and go beyond the typical loyalty construct. Key questions for retailers on using payments as a loyalty tool include:

- How can payments protect my customer relationships while enhancing customer experience and my brand?

- How can I offer a differentiated rewards value proposition using payments?

- How can I exploit payments data to deliver customized offers to customers?

An effective way for retailers to drive revenues is to integrate rewards management into the payment and checkout process, and to create personalized services that can help drive loyalty. Publishing relevant offers, coupons, and messaging linked to consumers’ payment preferences and shopping patterns will optimize the return on advertising expenditures.

For instance, Uber launched a new branded credit card in 2017 with Barclaycard. It enables customers to receive cash back for Uber-related purchases, including Uber Eats, encouraging more spending on Uber’s platforms. Similarly, Uber has partnerships with American Express and Visa that encourage cardholders to use Uber to gain credits.

USE PAYMENTS TO GENERATE ANCILLARY REVENUES

As a starting point to generating growth through payments, retailers should look for ways to create unique checkout solutions for customers consistent with their brand. These can take different forms as shown in Exhibit 3.

Referring to our previous best-in-class players, Amazon developed financial services enabling it to drive more revenues: For unbanked or underbanked customers, Amazon Cash offers a prepaid account that can be used for purchases on Amazon.com. Customers can preload cash (without any fees) to their Amazon accounts through several participating retailers.

On top of ancillary revenues, a strong payments infrastructure is critical in an omnichannel era where players must offer an integrated and seamless cross-channel shopping journey, including pick-ups and returns. Different payment platforms for physical and online operations complicate reconciliation, inventory, and refunds, and obscure the true cost of payments.

Exhibit 3: Revenue drivers for retailers using payments

Source: Oliver Wyman analysis

MANAGE THE TOTAL COST OF PAYMENTS

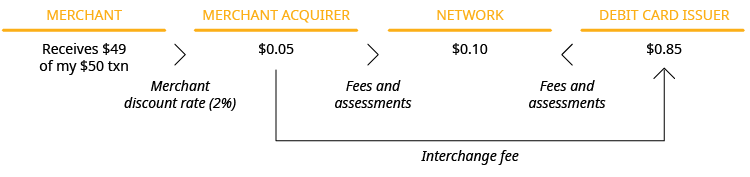

The illustrative scheme in Exhibit 4 shows the economics for the participants in a 50 US-Dollar credit card purchase and is subject to significant variability depending on:

Geography: National regulations have an impact on interchange fees and customers’ preferred payment types, such as cash, debit card, and credit card. How can retailers standardize processing fees in different jurisdictions and reduce the overall cost?

Cross-border or domestic commerce: International transaction fees can cost up to eight times as much as domestic because of factors such as dynamic currency conversion and VAT refunds. Are there ways to reduce costs resulting from international transactions?

Brand or type of card: Interchange levels vary by provider (such as Visa), tier (gold or silver, for example), and type (corporate or other). How can retailers optimize relationships with vendors and card issuers to minimize these interchange fees?

Exhibit 4: Payment fees breakdown per type of players in the payment value chains

Source: Oliver Wyman analysis

A more effective approach to capture greater value from this value chain for a merchant consists of

- Systematically breaking those costs down as per the above structure and building internal cost reference to challenge them individually. Such internal knowledge should, for example, establish that switch fees between the acquirer and the network typically range from one cent to five cents for a PIN debit operation in the United States.

- Approaching the market in a consolidated way, as acquirers and networks typically grant discounts for large-volume clients, which can reach 1 percent to 2 percent of the transaction value.

Retailers that have addressed these costs have achieved savings as high as 10 percent, and the results of some sustained initiatives have been even better.

THE PATH FORWARD

The payments space has been undergoing significant transformation in recent years. From being viewed as a cost of doing business, it has become a key enabler of an integrated and seamless shopping experience that provides a unique competitive advantage. Leading companies such as Amazon, Uber, and WeChat have made significant investments to implement successful payments strategies. These companies are shaping the future of shopping through an integrated, streamlined payment experience.

To offer their customers the best possible payment experience, retailers need to ask themselves the right questions in building their strategy:

- What are my customers’ needs and how can an improved payment experience help to fulfill them?

- How can I use payment to enable seamless, personalized interactions with my customers? What value-added services can I offer?

- What is the right way to think about my own proprietary forms of payment versus third-party forms of payment?

- How do I arrange finance and get organized to radically enhance my customers’ payment experience?

- Which partners or providers are best suited to support my journey?

- How do I strike the right balance between fraud management and customer experience?

- What implications do the global trends in data protection have for my payments strategy?

We believe the time for retailers to act is now. Payments can be a key tool in increasing revenues and growing overall businesses, while providing opportunities to reduce operating costs. However, deriving increased value from payments requires careful thought and execution, and finding the right partners when necessary.