Green finance is key to building climate resilient organizations and societies, and for climate change adaptation and mitigation. In 2016, sustainable investment rose 25 percent to $23 trillion from 2014. Yet, it is not enough. Two years on from the signing of the 2015 Paris Climate Agreement, one of the biggest challenges organizations and local and national governments still face is how to finance climate resilience and sustainable growth.

Closing the green financing gap is essential to meeting the sustainable development goals, and doing so will require greater collaboration between the public and private sectors to harness the global financial system’s potential, and mobilize private capital.

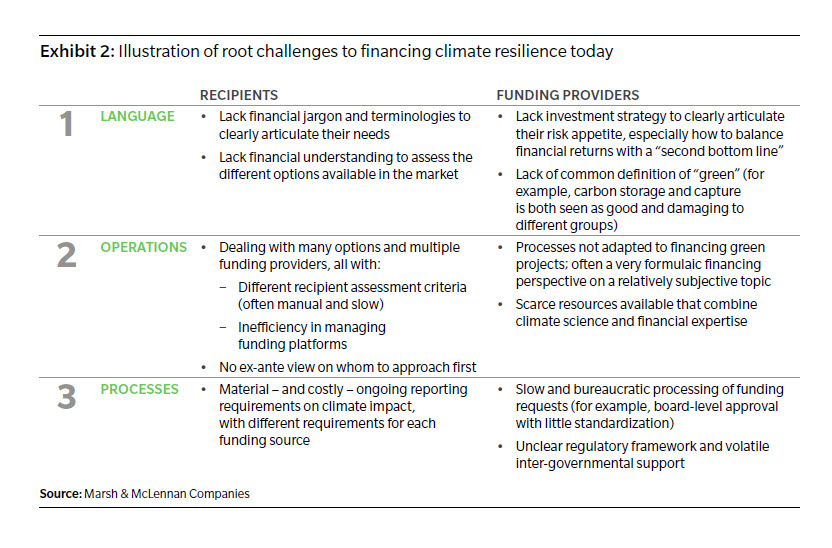

Enabling efficient transmission of funds to the appropriate green projects is key to meeting the challenges of climate change

Financing Climate Resilience is the first part of the 2018 Climate Resilience Handbook compiled by Marsh & McLennan Companies’ Global Risk Center. It provides expert insights from Guy Carpenter, Mercer and Oliver Wyman on how to address the factors inhibiting financing flows for green and sustainable investment, and how to finance climate resilience organizations and societies.

Link to press release

.pdf/_jcr_content/renditions/cq5dam.thumbnail.319.319.png)