by Bharath Sattanathan and Duncan Woods

Asia is digital. Over 1 billion Aadhar ID cards have been issued in India; the internet populations of China and India together outnumber the 3rd largest country in the world. A modular Asian financial-services industry is rapidly emerging, driven by and a response to digital trends. Yet while technology has displaced incumbents in many industries, for Asian banks, disruption to business models is more likely than displacement.

The potential digital disruption has several possible outcomes. Banks could prevail by embracing change. New banks could emerge. Incumbents could transform to survive. Or the whole banking system could be upended with different players assuming specialist roles across the value chain. As Asian Central Banks promote inclusive growth and push to digitize economies (such as the push for demonetization in India and a cashless economy in Thailand), regulators are looking to new, open and innovative financial systems that could change the business model of banks and marginalize them as balance-sheet players.

What strategies have Asian banks pursued to counteract this digital disruption?

Asian banks flirted with number of strategies in the first era of digital banking (circa 2012-2016). Most strategies had common threads: the focus was on “digital natives” (roughly 10% of the total bankable population); growth or defense was the primary motive given the perceived threat from FinTechs; transaction banking was the primary focus, but it was largely gilded with a digital veneer.

LESSONS FROM DIGITAL BANKING 1.0

BUSINESS MODEL

The 1st-mover advantage is over-rated, as most “digital banks” faced challenges with scaling. Capital requirements, challenges with client acquisition, and regulations prevented FinTechs from making a significant impact. One Malaysian bank found that acquiring new customers through digital channels, including aggregator websites, was twice as expensive as traditional channels. On top of that, the focus on “digital natives” made for a crowded segment with little differentiation and marginal profitability.

OPERATIONAL

Banks have realized they can achieve more through collaboration than by themselves, because FinTechs have the advantage of specialization and speed. In addition, banks initially underestimated the cultural and technological effort required to extract value from data, which forms the core of digital dexterity. One major Asian bank had cultural challenges when it encouraged the risk function to use alternative data from digital-accounting companies for underwriting SME customers. Another global bank with significant Asian operations was challenged to make real-time marketing decisions with real-time information that was available through external digital partnerships.

In addition, large incumbents have learned that the real growth opportunities still reside within the core business—not new spinoff digital ventures—and that the best ROE with digital is in end-to-end simplification of the core business.

A STRATEGIC FRAMEWORK FOR DIGITAL BANKING 2.0 (2016-?)

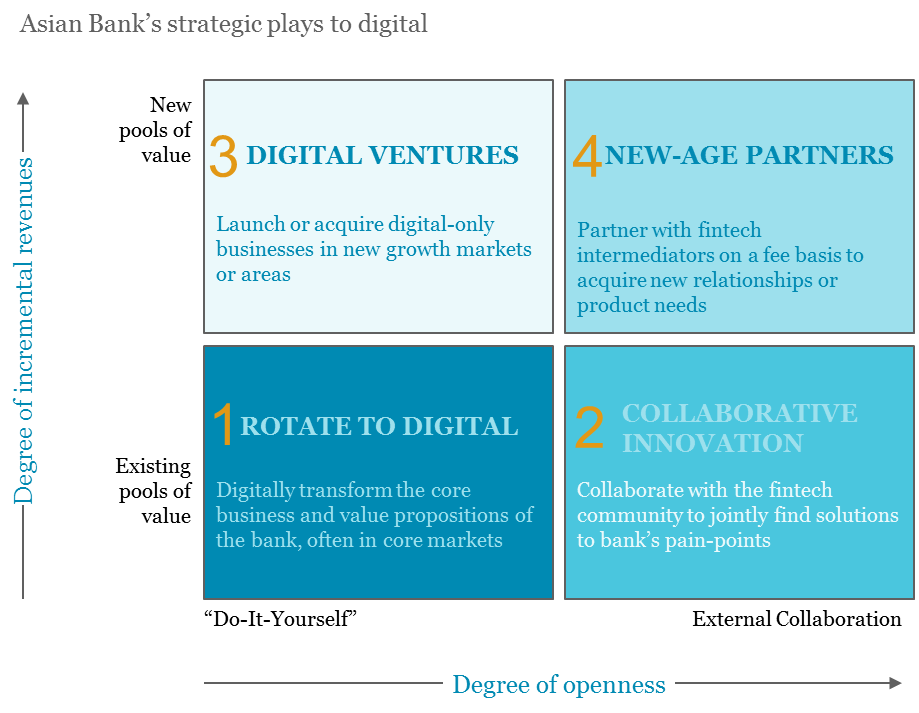

Banks should respond to threats and opportunities created by digital by pursuing four distinctive strategies (see “A Strategic Framework for Digital Banking 2.0”):

1. Rotate to Digital: Initiate digital transformations of the core franchises (for example, replace cash with mobile wallets).

2. Digital Ventures: Launch or acquire digital-only banks in new geographies or segments with little to no share, in search of growth.

3. New-Age Partnerships: Partner with digital companies to acquire customers or add new services (for example, partner with e-commerce companies to use order data for online-merchant financing).

4. Collaborative Innovation: Partner with FinTechs to jointly find solutions to pain-points (such as KYC, credit scoring, fraud, and risk).

What is the right strategic response? There are a number of factors, driven by internal readiness and market attractiveness. In our experience, banks both overestimate their readiness and underestimate the market opportunity.

Large incumbent banks can extract the most value from digital by applying it to core-value pools. Digital Banking 2.0 strategies will focus on driving simplicity and improving cost positions. Banks will need to drive innovation beyond transactions into lending and wealth. They should look to enlarge target populations (as digital is more widely adopted by consumers), and work with a range of ecosystem partners to embed finance as part of customers’ daily lives, redesigning user experiences with mobile-first principles

This pursuit of digital banking excellence calls for a change in mindset, requiring both enterprise innovation to drive agility, and collaboration with external parties. Depending on their starting point, banks may need to play a role across all quadrants. But at least now they can draw on lessons from recent history to guide them forward in the digital age.