At health insurance companies across the nation, actuaries are working to develop ACA premium rates. The 2018 rates must be submitted to regulators by the June 21 deadline, but the current uncertainty regarding health reform and the ACA exchanges is making actuaries’ task as difficult as it has ever been.

Two market influences, in particular, are complicating 2018 rate setting: the uncertainty surrounding continued funding of cost sharing reduction (CSR) payments and the question of how the relaxation of the individual mandate will impact enrollment and risk pools.

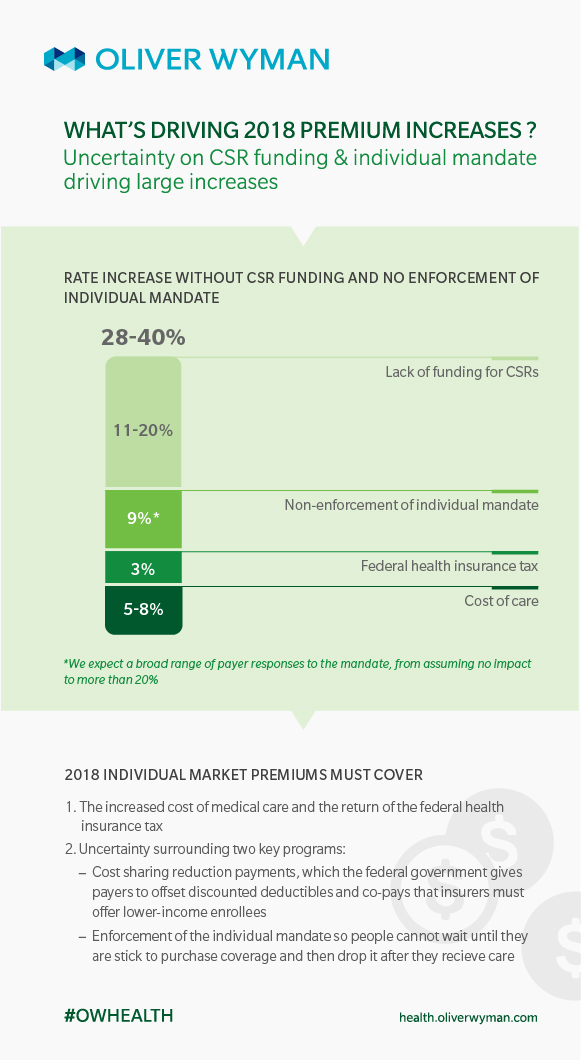

New analysis by Oliver Wyman projects that up to two-thirds of 2018 rate increases will be due to the uncertainty surrounding these two market influences. For example, if an insurer submits a rate increase of 30 percent, two-thirds of that increase will be attributable to the CSR and individual mandate uncertainty.

Here, Kurt Giesa, FSA, MAAA, partner with Oliver Wyman Actuarial Consulting, provides a summary of the analysis and offers a detailed look into how payers are likely to incorporate current uncertainties into their proposed rate increases.

Uncertainty is nothing new for actuaries, who routinely plan for and calculate the risk of things like an unexpected number of large claims or a severe flu season. Today, however, actuaries are having to adjust for uncertainty related to potential political decisions and actions. Specifically, the decision to relax enforcement of the ACA’s individual mandate and lack of clarity on CSR funding has actuaries setting rates without a clear view of what the 2018 ACA market or risk pool will look like.

Our modeling shows that this uncertainty, if it remains, could lead payers to submit rate increases between 28 and 40 percent, and more than two-thirds of those increases will be related to the uncertainty around CSR payments and individual mandate.

How are these issues clouding the view of 2018?

Next year will be the first time actuaries will need to build the lack of the enforcement of the mandate into their premiums. The lack of enforcement will have an impact on the risk pool, as it reduces incentives for the healthiest members of the risk pool to continue to pay for coverage. In addition, Congress and the administration have failed to provide clarity on whether payers will be paid for providing CSR policies in 2018.

The infographic below shows how we expect the uncertainty around these two issues will contribute to overall 2018 premium increases.

What’s in a rate increase?

Medical costs in the ACA non-group market are predicted to rise in 2018, and we expect medical trend to contribute between 5 percent and 8 percent to the rate increase.

The end of the moratorium on the health insurer tax is expected to add another 3 percent.

Our analysis (based on work we have done with our micro-simulation model) shows the non-enforcement of the individual mandate could contribute about 9 percent to premium increases. However, we expect payers’ estimates of this impact to vary widely, from no impact at all to 20 percent or more.

If payers do not gain clarity on funding of CSR payments soon, they will have to build that cost into their premiums. We used publicly available data to estimate how much payers are likely to increase premiums to cover this cost and project that premiums will rise by at least 11 percent in most markets, but could climb more than 20 percent, depending on the extent to which insureds are eligible for CSR policies.